Assigning Class Costs

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

LM_ACT_COST |

Specify class costs by cost ID. |

|

|

LM_ACT_FINCOST_SEC |

Select the financing organization that is funding a class cost and specify the amount funded. |

Use class costing to estimate the cost of a class. The system automatically calculates the costs of some resources, but you can also manually add and edit class costs.

The system calculates and reports the costs of:

All instructors who are attached to all sessions of the class.

All equipment that is attached to all sessions of the class.

All rooms that are attached to all sessions of the class.

All materials that are attached to the class.

The content for the class, which comes from the cost field of the associated delivery method.

The vendor product cost defined for the class's course.

If you attach a piece of equipment to a room, the cost of that item is not automatically calculated. If you want to cost the item to the class, then depending on your specific requirements, you can:

Add the equipment cost to the room cost.

Add a cost line manually to the Class Costs page.

After total costs are calculated, the system calculates the minimum and maximum enrollment costs and the cost per seat for the minimum and the maximum number of learners enrolled.

Cost Type

If you enter a cost when defining equipment, instructors, or rooms, you must specify the cost type. The cost type represents the unit of measure the cost represents and affects how the system calculates class costs. The following table describes how the system handles each cost type:

|

Cost Type |

How Costs are Calculated |

|---|---|

|

Hour |

The system calculates the number of hours that the item has been used by adding together the difference in hours between the start and end times for each session. This becomes the cost quantity, and the total cost is item (or unit) cost multiplied by quantity. The system rounds hours up to the nearest whole hour. |

|

Day |

Each session counts as a day. If your usage—that is, your session duration—within a whole day is short, you should consider changing to an hour cost type. Sometimes you may have multiple sessions in a day, such as a morning session in one room and an afternoon session in another room. If the sessions have the same instructor and the instructor is costed by the day, the day cost applies only once. |

|

Week |

The total number of days of the class (irrespective of the total number of sessions in those days) is divided by a standard working week number of days—5. The system rounds up partial weeks. Again, you have the option of using a smaller unit cost type if it suits your costing procedures better. |

|

Fixed |

The only calculation is to multiply by quantity, which is always one for equipment, instructors, and rooms. Materials are always a fixed cost, but when you attach them to a class, you enter the quantity. If the delivery method or vendor product has a cost, it is always a fixed cost, and the quantity is automatically one. |

|

Student |

The system multiplies the cost by the number of students that you enter on the Details tab on the Class Costs page. |

Note: You can override the quantity for a cost type of Hour, Day, Week, or Student on the Class Costs page; you cannot override the quantity for a fixed cost on this page.

Use the Maintain Classes - Class Costs page (LM_ACT_COST) to specify class costs by cost ID.

Navigation:

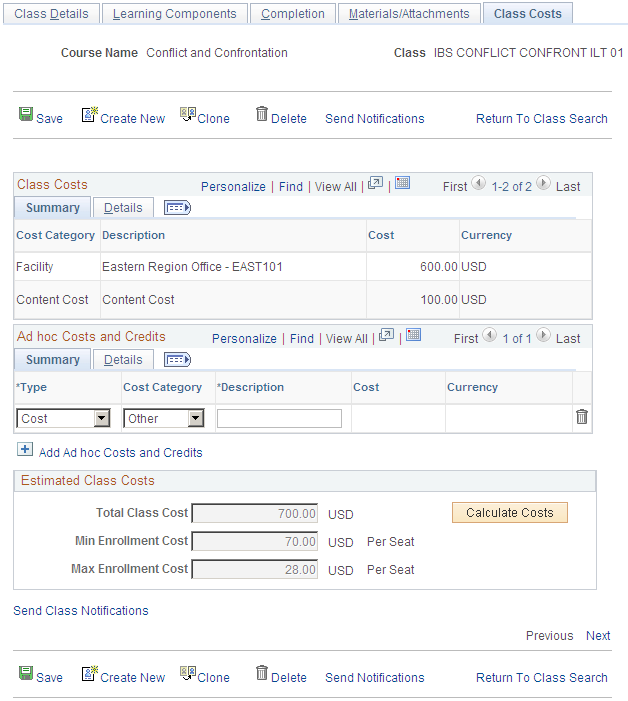

This example illustrates the fields and controls on the Maintain Classes - Class Costs page.

Note: The Cross Charge tabs appear only when the current administrator's learning environment is enabled for French features.

Class Costs

The Class Costs group box displays system-calculated costs.

Field or Control |

Description |

|---|---|

Cost Category and Description |

Indicates what the cost is for. Categories include content, equipment, facility, instructor, material, and vendor—anything that has a cost associated with it. A cost category of content always has a description of Content Cost, which is the cost of the delivery method that is used for the class. The room cost category is Facility. The cost category for equipment items that come from sessions is Equipment. Equipment that is attached to a room does not appear as a system-calculated cost. The description of the vendor cost is the name of the vendor product that is associated with the course. |

Cost |

This is the overall cost. When the category is Equipment, Facility, or Instructor, it can be a fixed cost where the number of sessions has no effect, or a unit cost multiplied by the quantity. The quantity represents the number of times used (or booked for a session), based on the cost type of hour, day, week, or number of students. You can update the quantity on the Details tab. When the cost category is Material, the cost is the unit cost, which is automatically the fixed cost type, multiplied by the quantity, where quantity is the number of items that you specified when you assigned the material to the class on the Materials and Attachments page. You can override the quantity on the Details tab. When the category is Vendor, the cost is the value entered in the Cost field on the Vendor Products page, which is automatically the fixed cost type, multiplied by a quantity of one. When the category is Content, the cost is the value defined in the Cost field of the Delivery Method page, which is automatically the fixed cost type, multiplied by a quantity of one. |

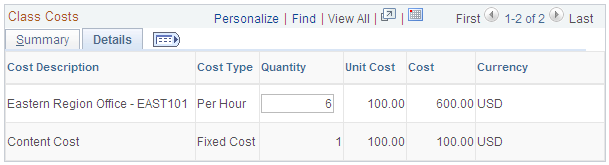

Class Costs: Details

Select the Class Costs: Details tab.

This example illustrates the fields and controls on the Class Costs: Details tab.

Click the Details tab in the Class Costs grid.

Field or Control |

Description |

|---|---|

Cost Type |

Indicates the cost frequency: Day, Fixed, Hour, Student, or Week. |

Quantity |

The quantity is multiplied by the unit cost to yield the total cost. You can enter a value in this field for all cost types except Content and Vendor, which have a fixed quantity of 1. When the cost type is student, no default value appears. You must enter a quantity so that the system can calculate the total cost. |

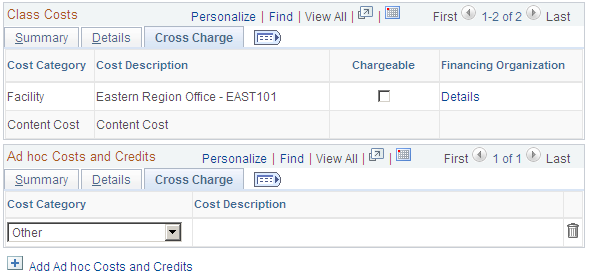

(FRA) Class Costs: Cross Charge

Click the Cross Charge tab in the Class Costs grid.

This example illustrates the fields and controls on the Class Costs: Cross Charge tab.

The Cross Charge tabs are accessible only when French features are enabled for the administrator's learning environment.

Field or Control |

Description |

|---|---|

Chargeable |

Select if any portion of this cost is chargeable for 2483 reporting purposes. Note: For equipment and vendors, you can designate only one cost as chargeable. When you publish learning costs to PeopleSoft HR: Administer Training, the system transmits only the chargeable cost. To transmit a facility or vendor cost, other than the system-calculated amount, it is recommended that you clear the Chargeable field for the system-generated cost and enter an ad hoc chargeable cost for the desired amount. |

Details |

Click to access the Financing Organization page where you can specify how much of the cost is being financed and select the financing organization. |

Ad Hoc Costs and Credits

Use the Ad Hoc Costs and Credits grid to enter costs for items that are not included in the system-calculated costs.

You could, for example, add the cost of an item of equipment in the rooms that you are using, if you haven't built the cost of the item into the room cost. (The Cost Category for room cost appears as Facility.)

You can also enter credits to offset costs that are associated with a class.

Field or Control |

Description |

|---|---|

Type |

Select Cost or Credit. |

Cost Category |

Select the cost category: Content, Equipment, Facility, Instr. Fee (instructor fee), Instructor, Material, Other, or Vendor. Select Instr. Fee to enter expenses for an instructor's meals, lodging, and other items. Select Instructor to record salary-related costs. When you select Vendor, you must also select a vendor product. You can only select from products offered by the vendor that is associated with the class's course. For credits, the only valid cost type is Other. Note: (FRA) Costs that have a cost category of Other or Content are never published to Administer Training, therefore, they are not included in the 2483 report. To have the 2483 report include expenses for student travel and other costs that Enterprise Learning Management does not publish, enter them through the Administer Training business process. |

Description |

When you select Other or Content as the cost category, you can enter a description of the cost here. |

Cost |

The system displays the total cost based on the quantity and units on the Details tab. |

Ad Hoc Costs and Credits: Details

Click the Details tab on the Ad Hoc Costs and Credits grid.

Field or Control |

Description |

|---|---|

Cost Type |

Select the cost frequency: Day, Fixed, Hour, Student, or Week. If you select Student, the Auto-Update Type field becomes available. |

Auto-Update Option |

Select whether you want the system to automatically derive the value of the Quantity field and how. This field is available only if you select Student in the Cost Type field. Values are: No Auto-Update: Allows you to manually enter a Quantity value. Current Enrollment: Derives the Quantity value from the Enrollment Total field on the Maintain Classes - Class Details page. Maximum Enrollment: Derives the Quantity value from the Max Enrollment (maximum enrollment) field on the Maintain Classes - Class Details page. Minimum Enrollment: Derives the Quantity value from the Min Enrollment (minimum enrollment) field on the Maintain Classes - Class Details page. |

Quantity |

For a cost type of Fixed the quantity is always 1. For all other cost types, enter the quantity. |

Unit Cost |

Enter the unit cost that corresponds to the unit type. |

Cost |

The system calculates the cost by multiplying the quantity by the unit cost. |

Ad Hoc Costs and Credits: Cross Charge

Click the Cross Charge tab on the Ad Hoc Costs and Credits grid.

This tab is similar to the Cross Charge tab on the Class Costs grid.

Estimated Class Costs

When you click the Calculate Costs button, the system asks if you want to reload class costs. If you select Yes, the system resets the quantity fields for the system-calculated costs to the default values, ignoring any changes that you have made to these fields. If you select No, the system calculates the class costs based on any updates you have made to the Quantity fields for the system-calculated costs.

When you click the Calculate Costs button, this group box shows the sum of the costs from the other two grids. The Min Enrollment Cost (minimum enrollment cost) and Max Enrollment Cost (maximum enrollment cost) fields are overall costs divided by the minimum enrollment and the maximum enrollment numbers that you entered on the Classes - Class Details page. If minimum and maximum fields are blank, the system cannot calculate per seat costs.

When the system calculates the estimated costs for the class, it uses the currency defined for the class. It there are resources with other currencies, it first converts the resource costs to the class's currency (as specified in the Pricing group box on the Classes - Class Details page).

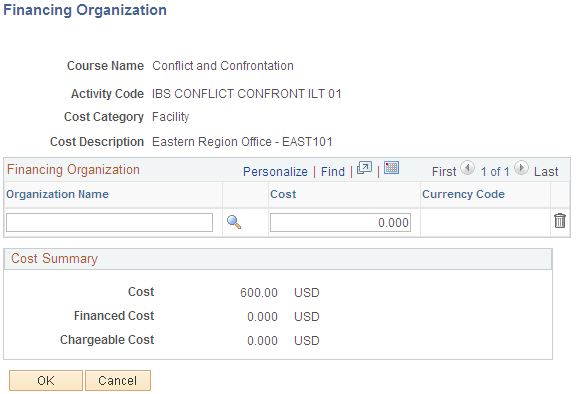

Use the Classes - Financing Organization page (LM_ACT_FINCOST_SEC) to select the financing organization that is funding a class cost and specify the amount funded.

Navigation:

Click Details on a Cross Charge tab on the Class Costs page.

This example illustrates the fields and controls on the Classes - Financing Organization page.

Select the financing organization that is funding all or part of the cost item and enter the amount financed. Use the Define Financing Organization (LM_FIN_ORG_MAIN) component to define financing organizations.

The Cost Summary group box displays the cost of the item as it appears on the Class Costs page and the financed amount that you entered on this page. If the Chargeable check box is selected on the Class Costs page, the system displays the Chargeable Cost, which represents the difference between the cost and the financed cost.