Setting Up Credit Card Interface Elements

This section discusses how to set up credit card interface elements.

Note: The information in this section is used for credit card integration using Integration Broker, or any manual processing that you have set up for credit card processing suppliers.

Before you can test a PeopleSoft credit card integration, you must set up a URL identifier on the URL Maintenance page ().

Before you set up credit card processing options, establish your merchant account with a third-party supplier.

Check the installation documentation for the product you are installing for specific details on setting up credit card interfaces.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EOEC_CCI_INSTAL |

Define connection parameters for credit card processing calls to a third-party supplier. Before you set up credit card processing options, establish your merchant account with a third-party supplier. |

|

|

EOEC_CCI_CARDTYPE |

Define the types of credit cards you accept for credit card processing. |

|

|

EOEC_CCI_TEST |

Enter test credit card information that you can submit to verify that your credit card processing is functioning properly. |

|

|

EOEC_CCI_TRANSACT |

Enter test credit card transaction information that you can submit to verify that your credit card processing is functioning properly. |

Use the Payment Processor page (EOEC_CCI_INSTAL) to define connection parameters for credit card processing calls to a third-party supplier.

Note: Before you set up credit card processing options, establish your merchant account with a third-party supplier.

Note: Check the installation documentation for the product you are installing for specific details on setting up credit card interfaces.

Navigation:

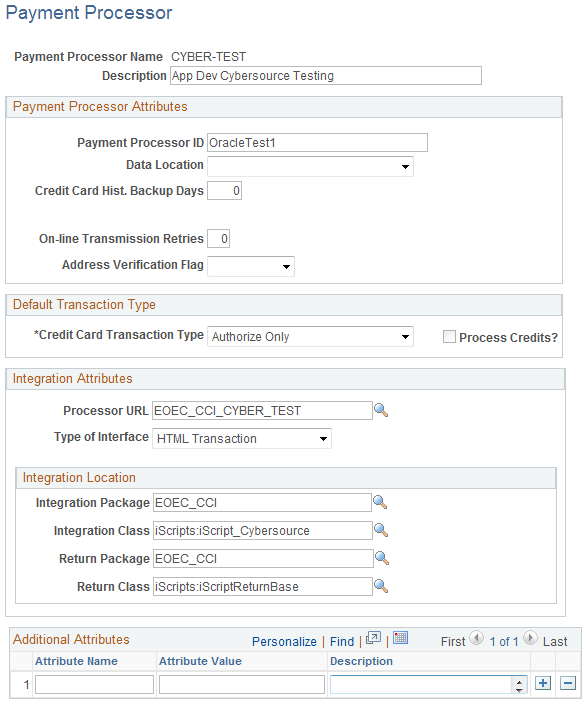

This example illustrates the fields and controls on the Payment Processor page. You can find definitions for the fields and controls later on this page.

Verify connection requirements with your third-party supplier.

Payment Processor Attributes

Field or Control |

Description |

|---|---|

Payment Processor ID |

Enter the processor name. The Payment Processor ID should correspond to your merchant account ID with the third-party supplier. |

Data Location |

Select from Hosted or Local. |

Credit Card Hist. Backup Days (credit card history backup days) |

If you create a process that archives history records, specify the number of days that you retain credit card authorization history records. |

On-line Transmission Retries |

Enter a value from 0 through 9 to specify how many times the system should attempt to retransmit transactions in the event of transmission failure. |

Address Verification Flag |

Credit card transmissions can fail authorization if the address that you send doesn't exactly match the billing address for the credit card. Select from: Add Ver ON (address verification on): Transactions fail when the address that you send does not match the credit card billing address. This is the default value. Add Vf OFF (address verification off): Transactions do not fail when the address that you send does not match the billing address on the credit card. |

Default Transaction Type

Field or Control |

Description |

|---|---|

Credit Card Transaction Type |

Select the types of transactions that your agents are allowed to submit. Disallowed transaction types are not available on the application-specific credit card transaction page. Select from: Authorization Reversal: Your supplier can cancel the transaction after authorization and before payment is received. This makes the funds available if the transaction is cancelled. Authorize Bill Subscription Authorize Only: Your supplier verifies that the card is valid for the charge. For example, the customer has enough credit to pay for the order, the card is not stolen, and so forth. The supplier does not bill the credit card. Authorize Subscription Authorize and Bill: Your supplier performs both authorization and billing during the same transaction. The supplier charges the customer’s credit card on receiving authorization. Bill Only: Your supplier bills the card without first verifying that the card is valid for the charge. Select this option if you have preauthorized the transaction and you want to submit the transaction for billing only. Create Account Credit Only: Your supplier credits the customer’s credit card. Delete Account Error Modify Account Retrieve Subscription |

Process Credits? |

Select to permit agents to submit credit transactions as well as billing transactions. This option is available only when you select Authorize and Bill or Credit Only in the Credit Card Transaction Type field. |

Integration Attributes and Integration Location

The third-party supplier that you integrate with will provide you with information to connect with their systems. Enter that information to enable your PeopleSoft system to make the connection when you submit a transaction for processing.

Field or Control |

Description |

|---|---|

Processor URL |

Enter the URL identifier that corresponds to the URL for the merchant integration point. You define the URL identifier on the URL Maintenance page (). |

Type of Interface |

Select HTML Transaction or Integration Broker. |

Integration Package and Integration Class |

Enter the Application Package and Application Class that holds the integration iScript PeopleCode. This class must extend EOEC_CCI:iScripts:iScriptBuilderBase. |

Return Package and Return Class |

Enter the Application Package and Application Class that holds the iScript PeopleCode for return processing. The default class parses the URL return parameters and stores them in the Global Object. |

Additional Attributes

The Additional Attributes grid contains a name/value pair attribute system for third-party supplier definitions and stores integration attributes that are not captured in the main section of the payment processor information. For example, a third-party supplier may require each integrating system to store and leverage a security script. Another possible use for the additional attributes section is to store provider-specific integration properties that you would like to customize for the PeopleSoft customer.

Use the Card Type page (EOEC_CCI_CARDTYPE) to define the types of credit cards you accept for credit card processing.

Navigation:

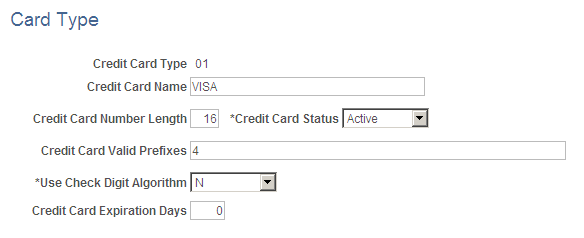

This example illustrates the fields and controls on the Card Type page. You can find definitions for the fields and controls later on this page.

Use this page to define the types of credit cards that you accept for credit card processing.

Oracle delivers data for most popular credit card types. You can modify existing definitions and add new ones.

Field or Control |

Description |

|---|---|

Credit Card Type |

Enter a value for the credit card. |

Credit Card Name |

Enter a credit card name such as Visa or MasterCard. The name should match the credit card type so that you can identify the card without memorizing the credit card type codes. |

Credit Card Number Length |

Enter the card's standard credit card number length. Before transmitting a request to your supplier, the system validates the length of the credit card number against this number. |

Credit Card Status |

Select Active if you accept this type of credit card. Select Inactive if you don’t accept this type of credit card. Inactive credit card types do not appear on the application-specific credit card transaction page or in the Test Credit Card Interface component. The default value for this field is Inactive. |

Credit Card Valid Prefixes |

Enter all valid prefixes for this type of credit card. Enter multiple prefixes in comma-separated format with no spaces in between. The system removes any characters other than numbers and commas when you move to another field. Before transmitting a request to your supplier, the system validates that the credit card number starts with a valid prefix. |

Use Check Digit Algorithm |

Select Y (yes) to use the modulus (MOD) 10 check digit algorithm to validate credit card numbers before transmitting requests to your supplier. The MOD 10 check digit algorithm verifies whether card numbers you enter into the system are legitimate. The default value for this field is N. |

Credit Card Expiration Days |

Enter a four digit numerical expiration value. |

Use the Test Credit Card Interface - Card Entry/Display page (EOEC_CCI_TEST) to enter test credit card information that you can submit to verify that your credit card processing is functioning properly.

Navigation:

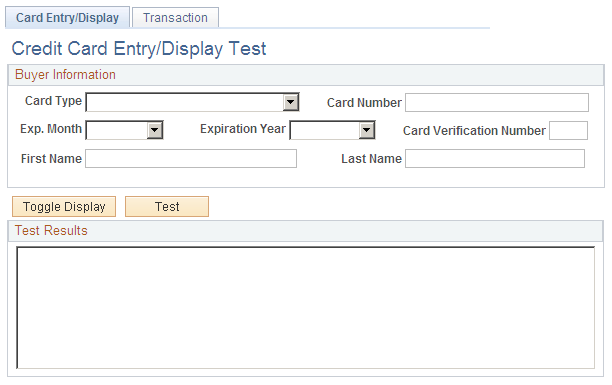

This example illustrates the fields and controls on the Test Credit Card Interface - Card Entry/Display page. You can find definitions for the fields and controls later on this page.

Use this page to enter test credit card information that you can submit to verify that your credit card processing is functioning properly.

The test that you can run on this page:

Verifies that the card number you enter meets the requirements defined in the Credit Card Valid Prefixes field for the associated card type on the Card Type page.

If you have set the Use Check Digit Algorithm field value to Y, verifies that the card number is valid based on the MOD 10 check digit algorithm.

Verifies that you have entered values in the Exp. Month, Expiration Year, First Name and Last Name fields on this page.

You can use the following credit card sample data in your test transactions:

|

Credit Card Type |

Credit Card Number |

|---|---|

|

American Express |

378282246310005 |

|

Diners Club/Carte Blanche |

38000000000006 |

|

Discover |

6011111111111117 |

|

MasterCard |

5555555555554444 |

|

Visa |

4111111111111111 |

Field or Control |

Description |

|---|---|

Card Type |

Select a card type to test. Available values are defined on the Credit Card Types page. |

Credit Card Number |

Enter the credit card number to test. |

Exp. Month (expiration month), Expiration Year, Card Verification Number, First Name and Last Name |

Enter card information to test. Card verification number is optional in running credit card tests. |

Toggle Display |

Click to switch between display-only and editable modes. |

Test |

Click to begin the test. |

Test Results |

The results of the test appear in this text box. If the card number is valid, the message VALID CARD NUMBER appears. If the card number is not valid, an explanatory message appears; the card number is incorrect or the card is expired, for example. |

Use the Test Credit Card Interface - Transaction page (EOEC_CCI_TRANSACT) to enter test credit card transaction information that you can submit to verify that your credit card processing is functioning properly.

Navigation:

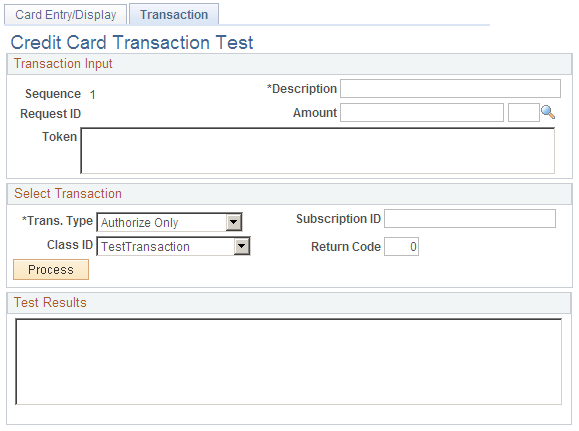

This example illustrates the fields and controls on the Test Credit Card Interface - Transaction page. You can find definitions for the fields and controls later on this page.

Use this page to enter test credit card transaction information that you can submit to verify that your credit card processing is functioning properly.

The test that you can run on this page verifies that your environment is set up correctly to process online credit card transactions using XML Compliant integration.

Note: This does not test the environment that is set up for batch credit card transactions.

Field or Control |

Description |

|---|---|

Sequence and Request ID |

Display a combination of numbers that distinguishes the transaction from other transactions. The combination of numbers are similar to a run control or job number. |

Amount |

Enter a transaction amount and click the Look up button to select a transaction currency. |

Token |

The token is a response value that is returned from the Credit Card processing service. It is another validation that can be referenced in regards to a specific transaction. |

Trans. Type (transaction type) |

Choose a transaction type to test: Auth/Bill (Authorization/Bill): Perform both authorization and billing during the same transaction. AuthRev (Authorization Reversal): Cancel the transaction after authorization and before payment is received. Authorize: (default value) Verify that the card is valid for the charge. Bill: Bill the card without first verifying that the card is valid for the charge. Credit: Credit the customer’s credit card. |

Class ID |

Select TestTransaction (the default) or one of the following interface types that has been specified on the Credit Card Interface Installation page. ProcessBrokerTransaction: Select if you want to test your XML-based interface. InterlinkTransaction: Select if you want to test your Business Interlink interface. |

Process |

Click to process the test transaction. |

Return Code |

Enter a return code to test whether proper error messages and results are returned. Available codes and their descriptions are discussed in the Return Codes section subsequently. |

Test Results |

The results of the transaction test appear in this text box. Test result interpretations are discussed in the following sections. |

Return Codes

You can enter any of the following return codes and click Process to view the corresponding description and error message in the Test Results area. These return codes and their corresponding error messages can appear in multiple areas. For example, when you are using the Test Credit Card Interface component, they appear on this test page. In an application, they appear as appropriate for that application's method of interacting with the credit card interface.

|

Return Code |

Description |

|---|---|

|

-3 |

Error Opening Trace File |

|

-4 |

Vendor Error − ICS_INIT failed |

|

-5 |

Unsupported Service |

|

-6 |

Credit card number is invalid |

|

-7 |

Phone number is too long |

|

-8 |

State field length is invalid |

|

-9 |

Zip Code field is too long |

|

-10 |

Amount must be greater than zero |

|

-11 |

Vendor Error − ICS_SEND failed |

|

-12 |

Decryption Failed |

|

-15 |

Request ID is required |

|

-16 |

Currency is required |

|

-17 |

Phone is required |

|

-18 |

Email ID is required |

|

-19 |

Zip Code is required |

|

-20 |

City is required |

|

-21 |

Country code is required |

|

-23 |

Address 1 is required |

|

-99 |

Trace Run Only |